Chapter 6 Code#

We start with some imports.

import numpy as np

import matplotlib.pyplot as plt

from numba import jit, vectorize

from interpolation import interp

from scipy.interpolate import interp1d

from scipy.optimize import minimize_scalar, brentq

from scipy.stats import beta

First Steps#

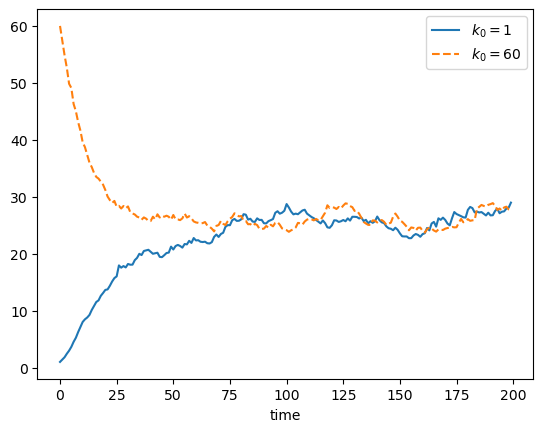

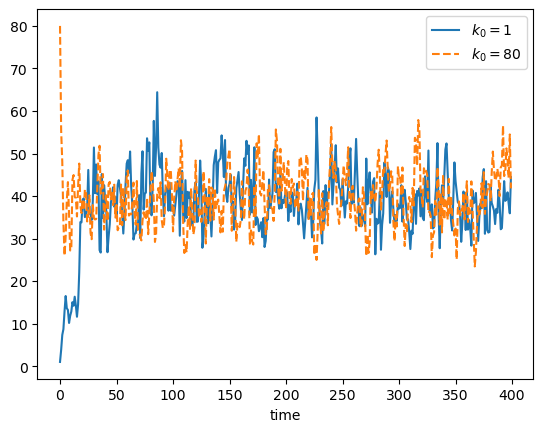

Here is the code that generated figure 6.1.

alpha = 0.5 # capital intensity

sigma = 0.2 # shock parameter

s = 0.5 # savings rate

delta = 0.1 # depreciation

default_params = alpha, sigma, s, delta

@jit

def f(k, params=default_params):

alpha, sigma, s, delta = params

return k**alpha

@jit

def update(k, params=default_params):

alpha, sigma, s, delta = params

w = np.exp(sigma * np.random.randn())

new_k = s * f(k) * w + (1 - delta) * k

return new_k

@jit

def generate_solow_ts(init=1, ts_length=200, params=default_params):

" A function to generate time series. "

k = np.empty(ts_length)

k[0] = init

for t in range(ts_length-1):

k[t+1] = update(k[t], params=params)

return k

fig, ax = plt.subplots()

ax.plot(generate_solow_ts(init=1), label='$k_0 = 1$')

ax.plot(generate_solow_ts(init=60), '--', label='$k_0 = 60$')

ax.legend()

ax.set_xlabel('time')

#plt.savefig('solow_ts.pdf')

plt.show()

Here is a function to generate draws from the time \(t\) marginal distribution of capital.

@jit

def sim_from_marginal(t=10, init=1, sim_size=1000, params=default_params):

k_draws = np.empty(sim_size)

for i in range(sim_size):

k = init

for j in range(t):

k = update(k, params=params)

k_draws[i] = k

return k_draws

Now we generate some draws for date \(t=20\) under the default parameters and take the mean, which solves exercise 6.2.

draws = sim_from_marginal(t=20)

draws.mean()

12.839504369873978

Here is the solution to exercise 6.3.

new_s = 3/4

new_params = alpha, sigma, new_s, delta

draws = sim_from_marginal(t=20, params=new_params)

draws.mean()

26.567628148149396

Not surprisingly, mean capital stock at this (and any given) date is higher, due to higher savings.

Here is the solution to exercise 6.4.

init_values = 5, 10, 20

for init_k in init_values:

draws = sim_from_marginal(t=20, init=init_k)

print(f"Mean capital from initial condition {init_k} is {draws.mean():.2f}")

Mean capital from initial condition 5 is 16.50

Mean capital from initial condition 10 is 19.29

Mean capital from initial condition 20 is 23.71

Higher initial capital leads to higher mean capital at \(t=20\).

This is as expected, since the law of motion for capital is increasing in lagged capital.

Here is the solution to exercise 6.5.

dates = 50, 100, 200

for date in dates:

draws = sim_from_marginal(t=date)

print(f"Mean capital at {date} is {draws.mean():.2f}")

Mean capital at 50 is 22.79

Mean capital at 100 is 25.68

Mean capital at 200 is 25.96

Mean capital is slightly increasing, although it stabilizes as \(t \to \infty\).

The initial increase is due to the fact that the initial condition is relatively small. Hence we see growth on average, as shown in the time series plot starting from \(k_0=1\) above.

For exercise 6.6 we compute the 95% confidence interval as follows

draws = sim_from_marginal(t=20)

n = len(draws)

k_bar = draws.mean()

sigma_hat = draws.std()

c = 1.96

lower = k_bar - (sigma_hat / np.sqrt(n)) * c

upper = k_bar + (sigma_hat / np.sqrt(n)) * c

print(f"Sample mean is {k_bar:.4f}")

print("The 95% Confidence interval is ", [round(x, 4) for x in (lower, upper)])

Sample mean is 12.7869

The 95% Confidence interval is [12.723, 12.8508]

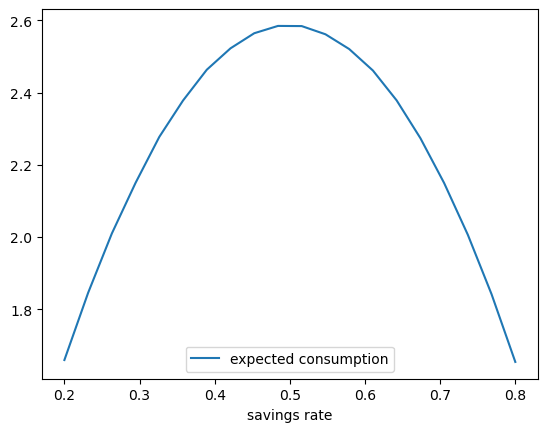

For exercise 6.7 we approximate steady state consumption at a range of savings values using the method described in the exercise.

m = 100_000

min_s, max_s, grid_size = 0.2, 0.8, 20

savings_rates = np.linspace(min_s, max_s, grid_size)

expected_consumption = np.empty_like(savings_rates)

for i, s in enumerate(savings_rates):

params = alpha, sigma, s, delta

draws = sim_from_marginal(t=100, sim_size=m, params=params)

w_vec = np.exp(sigma * np.random.randn(m))

c_bar = np.mean( (1-s) * f(draws) * w_vec )

expected_consumption[i] = c_bar

fig, ax = plt.subplots()

ax.plot(savings_rates, expected_consumption, label='expected consumption')

ax.legend()

ax.set_xlabel('savings rate')

#plt.savefig('solow_golden.pdf')

plt.show()

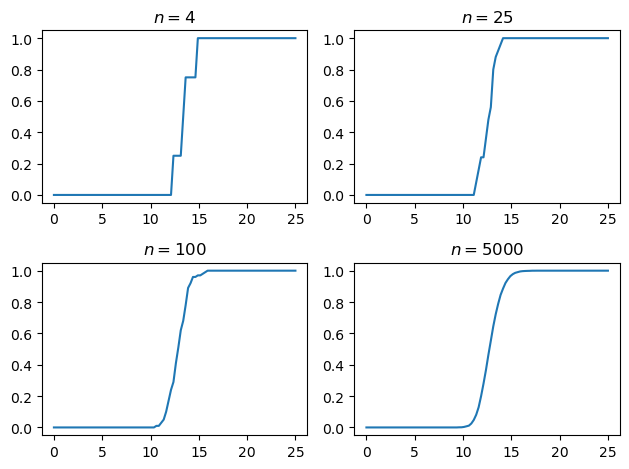

Exercise 6.8 asks us to compute the empirical distribution of \(\psi_t\) when \(t=20\) at different sample sizes.

fig, axes = plt.subplots(2, 2)

axes = axes.flatten()

sample_sizes = 4, 25, 100, 5000

grid_points = np.linspace(0, 25, 100)

for ax, n in zip(axes, sample_sizes):

draws = sim_from_marginal(t=20, sim_size=n)

ecdf_vals = [np.mean(draws <= x) for x in grid_points]

ax.plot(grid_points, ecdf_vals)

ax.set_title(f"$n={n}$")

plt.tight_layout()

#plt.savefig('solow_ecdf.pdf')

plt.show()

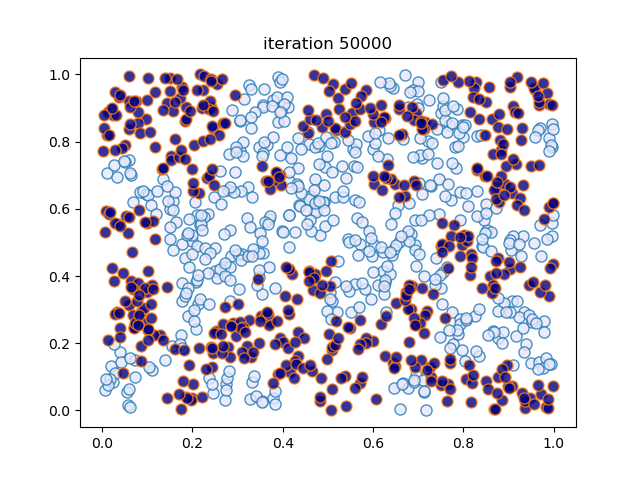

Our next task is to simulate from the “threshold exernalities” model.

The following code generates figures 6.6 and 6.7.

alpha = 0.5 # capital intensity

s = 0.25 # savings rate

sigma = 0.14 # shock parameter

delta = 1.0 # depreciation

A1, A2 = 15, 25

k_b = 21.6

@jit

def A(k):

return A1 if k < k_b else A2

@jit

def f(k):

return k**alpha

@jit

def update(k):

w = np.exp(sigma * np.random.randn())

new_k = s * A(k) * f(k) * w + (1 - delta) * k

return new_k

@jit

def generate_ad_ts(init=1, ts_length=400):

k = np.empty(ts_length)

k[0] = init

for t in range(ts_length-1):

k[t+1] = update(k[t])

return k

fig, ax = plt.subplots()

ax.plot(generate_ad_ts(init=1), label='$k_0 = 1$')

ax.plot(generate_ad_ts(init=80), '--', label='$k_0 = 80$')

ax.legend()

ax.set_xlabel('time')

#plt.savefig('adtssim.pdf')

plt.show()

The next piece of code computes an approximation of the first passage time above \(k_b\) using simulation.

@jit

def draw_tau():

tau = 0

k = 1

while k < k_b:

k = update(k)

tau += 1

return tau

def tau_draws(m=10_000):

draws = np.empty(m)

for i in range(m):

draws[i] = draw_tau()

print(np.mean(draws))

12.795937127286848

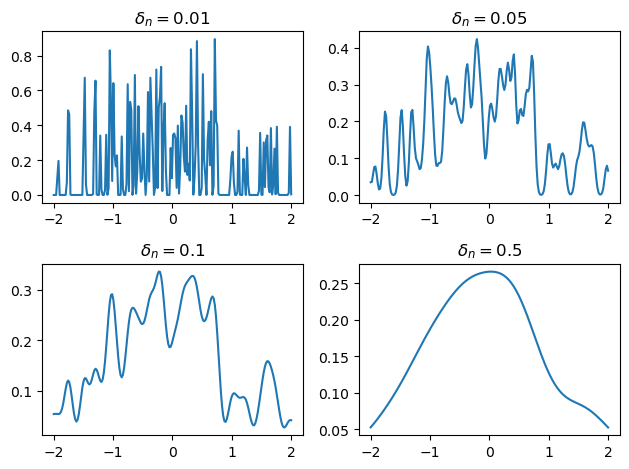

Here is a solution to Exercise 6.11, which implements a kernel density estimator and tests it on some data.

The kernel density estimator uses a Gaussian kernel and is implemented via a closure.

We use the vectorize decorator from Numba to ensure that the function can act

correctly on arrays as well as scalars.

k0 = np.sqrt(1 / (2 * np.pi)) # for Gaussian kernel

@jit

def K(z):

return k0 * np.exp(-z**2)

def kde_factory(data, delta):

@vectorize

def kde(x):

return (1 / delta) * np.mean( K((x - data) / delta) )

return kde

Now we produce the figure.

Y = np.random.randn(100)

deltas = 0.01, 0.05, 0.1, 0.5

x_grid = np.linspace(-2, 2, 200)

fig, axes = plt.subplots(2, 2)

axes = axes.flatten()

for delta, ax in zip(deltas, axes):

f = kde_factory(Y, delta)

ax.plot(x_grid, f(x_grid))

ax.set_title(rf"$\delta_n = {delta}$")

plt.tight_layout()

#plt.savefig("kdes.pdf")

plt.show()

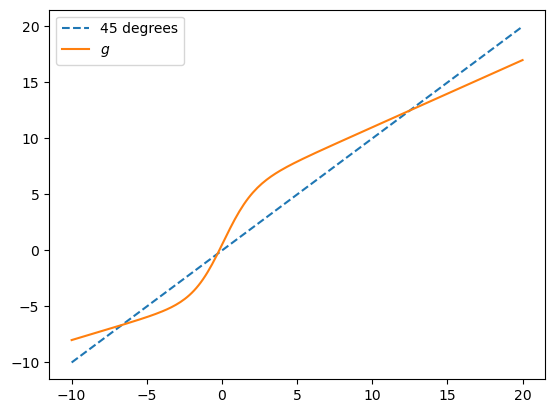

Next we turn to exercise~6.12, which concerns the STAR model.

We will use a jitclass, which requires us to set up parameters.

from numba import float64

from numba.experimental import jitclass

star_data = (

('alpha_0', float64),

('alpha_1', float64),

('beta_0', float64),

('beta_1', float64)

)

Next we set up the class, which implements the law of motion and the stochastic kernel.

@jitclass(star_data)

class STAR:

def __init__(self, alpha_0=-4.0, alpha_1=0.4, beta_0=5.0, beta_1=0.6):

self.alpha_0, self.alpha_1 = alpha_0, alpha_1

self.beta_0, self.beta_1 = beta_0, beta_1

def G(self, x):

" Logistic function "

return 1 / (1 + np.exp(-x))

def g(self, x):

" Smooth transition function "

a = (self.alpha_0 + self.alpha_1 * x) * (1-self.G(x))

b = (self.beta_0 + self.beta_1 * x) * self.G(x)

return a + b

def update(self, x):

" Update by one time step. "

W = np.random.randn()

return self.g(x) + W

def draws_from_marginal(self, t_date, init=0, n=10_000):

draws = np.empty(n)

for i in range(n):

X = init

for t in range(t_date):

X = self.update(X)

draws[i] = X

return draws

def phi(self, z):

" Standard normal density "

return k0 * np.exp(-z**2)

def p(self, x, y):

" Stochastic kernel "

return self.phi(y - self.g(x))

s = STAR()

x_grid = np.linspace(-10, 20, 200)

fig, ax = plt.subplots()

ax.plot(x_grid, x_grid, '--', label='45 degrees')

ax.plot(x_grid, s.g(x_grid), label='$g$')

ax.legend()

#plt.savefig("star_g.pdf")

plt.show()

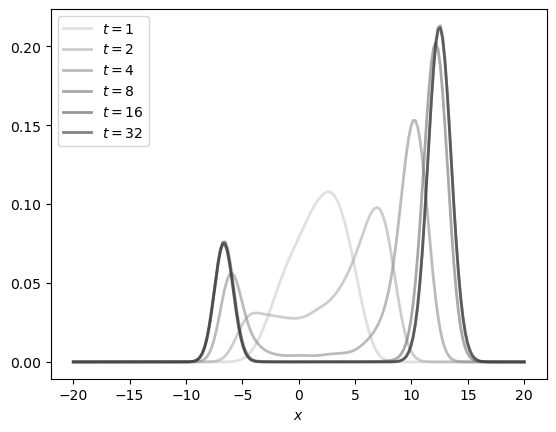

Now we use a closure to produce a look ahead estimator of the time \(t\) marginal given a stochastic kernel and a set of draws from time \(t+1\).

def lae_factory(p, x_data):

def f(y):

return np.mean(p(x_data, y))

return f

This code solves exercise 6.12.

dates = 1, 2, 4, 8, 16, 32

y_grid = np.linspace(-20, 20, 200)

greys = [str(g) for g in np.linspace(0.2, 0.8, len(dates))]

greys.reverse()

s = STAR()

fig, ax = plt.subplots()

for t, g in zip(dates, greys):

x_obs = s.draws_from_marginal(t)

f = lae_factory(s.p, x_obs)

ax.plot(y_grid,

[f(y) for y in y_grid],

color=g,

lw=2,

alpha=0.6,

label=f'$t={t}$')

ax.set_xlabel('$x$')

ax.legend()

#plt.savefig("starseq.pdf")

plt.show()

Solutions to exercises 6.13 – 6.15 are omitted. They can be solved using techniques similar to those described above and immediately below.

We complete section 6.1 by solving exercise 6.16.

ad_data = (

('alpha', float64),

('s', float64),

('sigma', float64),

('A1', float64),

('A2', float64),

('k_b', float64),

)

@jitclass(ad_data)

class AD:

def __init__(self,

alpha=0.5,

s=0.25,

sigma=0.14,

A1=15,

A2=25,

k_b = 21.6):

self.alpha, self.s, self.sigma = alpha, s, sigma

self.A1, self.A2, self.k_b = A1, A2, k_b

def A(self, k):

return self.A1 * (k < self.k_b) + self.A2 * (k >= self.k_b)

def f(self, k):

return k**self.alpha

def update(self, k):

w = np.exp(self.sigma * np.random.randn())

new_k = self.s * self.A(k) * self.f(k) * w

return new_k

def generate_ts(self, init=1, ts_length=100_000):

k = np.empty(ts_length)

k[0] = init

for t in range(ts_length-1):

k[t+1] = self.update(k[t])

return k

def phi(self, z):

" Lognormal density for N(0, sigma^2) "

a = k0 / (z * self.sigma)

b = np.exp(- np.log(z)**2 / (2 * self.sigma**2))

return a * b

def p(self, x, y):

z = self.s * self.A(x) * self.f(x)

return self.phi(y/z) / z

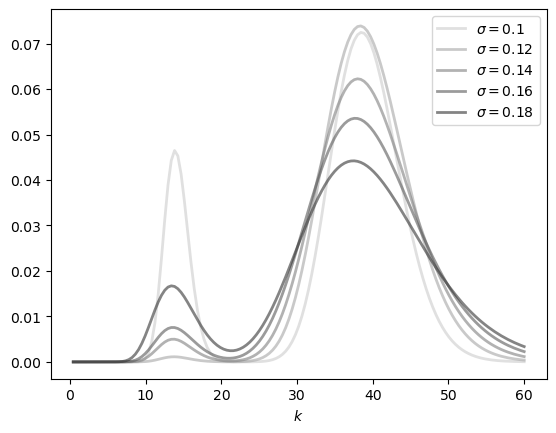

Now we use the class to generate the figure.

sigmas = 0.1, 0.12, 0.14, 0.16, 0.18

y_grid = np.linspace(0, 60, 140)

greys = [str(g) for g in np.linspace(0.2, 0.8, len(sigmas))]

greys.reverse()

fig, ax = plt.subplots()

for sigma, g in zip(sigmas, greys):

ad = AD(sigma=sigma)

x_obs = ad.generate_ts()

f = lae_factory(ad.p, x_obs)

ax.plot(y_grid,

[f(y) for y in y_grid],

color=g,

lw=2,

alpha=0.6,

label=rf'$\sigma={sigma}$')

ax.set_xlabel('$k$')

ax.legend()

#plt.savefig("ad_sdla.pdf")

plt.show()

Optimal Savings#

Optimization routines in the Python numerical tool set typically perform minimization.

It is useful for us to have a function maximizises a map g over an interval [a, b].

We use the fact that the maximizer of g on any interval is also the minimizer of -g.

def maximize(g, a, b, args):

"""

Returns the maximal value and the maximizer.

The tuple args collects any extra arguments to g.

"""

objective = lambda x: -g(x, *args)

result = minimize_scalar(objective, bounds=(a, b), method='bounded')

maximizer, maximum = result.x, -result.fun

return maximizer, maximum

class OptimalSaving:

def __init__(self,

U, # utility function

R=1.05, # gross return on saving

rho=0.96, # discount factor

b=0.1, # shock scale parameter

grid_max=2,

grid_size=120,

shock_size=250,

seed=1234):

self.U, self.R, self.rho, self.b = U, R, rho, b

# Set up grid

self.grid = np.linspace(1e-4, grid_max, grid_size)

# Store shocks (with a seed, so results are reproducible)

np.random.seed(seed)

self.shocks = np.exp(b * np.random.randn(shock_size))

def state_action_value(self, s, a, v_array):

"""

Right hand side of the Bellman equation.

"""

U, R, rho, shocks = self.U, self.R, self.rho, self.shocks

v = interp1d(self.grid,

v_array,

fill_value=(v_array[0], v_array[-1]),

bounds_error=False)

return U(a-s) + rho * np.mean(v(R * s + shocks))

In the last line, the expectation is computed via Monte Carlo.

Now we write up the Bellman operator.

def T(v, os):

"""

The Bellman operator. Updates the guess of the value function

and also computes a v-greedy policy.

* os is an instance of OptimalSaving

* v is an array representing a guess of the value function

"""

v_new = np.empty_like(v)

v_greedy = np.empty_like(v)

for i in range(len(os.grid)):

a = os.grid[i]

# Maximize RHS of Bellman equation at state a

c_star, v_max = maximize(os.state_action_value, 1e-10, a, (a, v))

v_new[i] = v_max

v_greedy[i] = c_star

return v_greedy, v_new

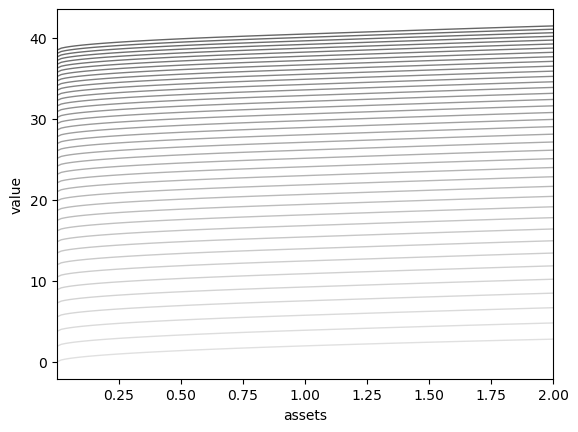

Here is a figure showing the function sequence generated by value function iteration, starting at the utility function.

def solve_model(os,

tol=1e-4,

max_iter=1000,

verbose=True,

print_skip=25):

"""

Solve the model by iterating with the Bellman operator.

* os is an instance of OptimalSaving

"""

# Set up loop

v = U(os.grid) # Initial condition

i = 0

error = tol + 1

while i < max_iter and error > tol:

v_greedy, v_new = T(v, os)

error = np.max(np.abs(v - v_new))

i += 1

if verbose and i % print_skip == 0:

print(f"Error at iteration {i} is {error}.")

v = v_new

if i == max_iter:

print("Failed to converge!")

if verbose and i < max_iter:

print(f"\nConverged in {i} iterations.")

return v_greedy, v_new

Let us put this code to work.

@jit

def U(c, gamma=0.5):

"The utility function."

return c**(1 - gamma) / (1 - gamma)

os = OptimalSaving(U)

#v = U(os.grid) # Initial condition

v = np.zeros_like(os.grid) # Initial condition

n = 40 # Number of iterations

greys = [str(g) for g in np.linspace(0.0, 0.8, n)]

greys.reverse()

fig, ax = plt.subplots()

for i in range(n):

v_greedy, v = T(v, os) # Apply the Bellman operator

ax.plot(os.grid, v, color=greys[i], lw=1.0, alpha=0.6)

ax.set_xlabel('assets')

ax.set_ylabel('value')

ax.set(xlim=(np.min(os.grid), np.max(os.grid)))

plt.show()

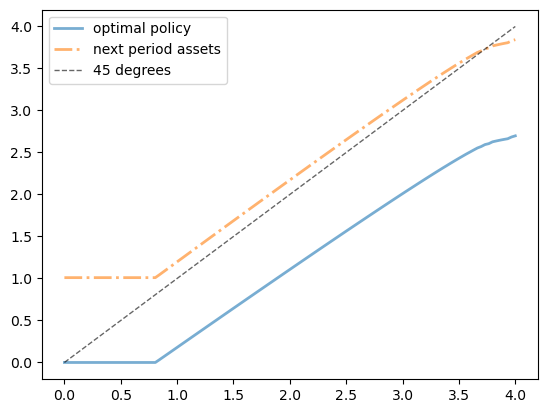

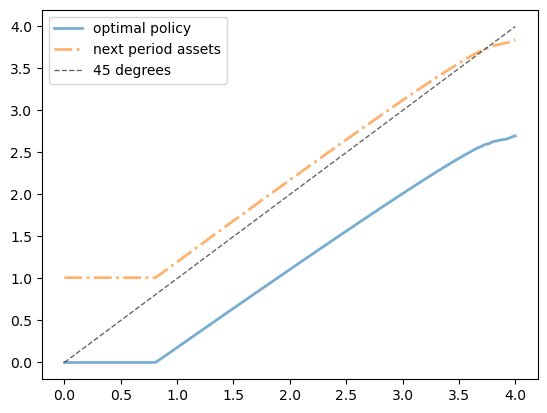

The next code block uses a more systematic method to find a good approximation to the value function and then computes the associated greedy policy.

os = OptimalSaving(U, grid_max=4)

sigma_star, v_star = solve_model(os)

fig, ax = plt.subplots()

ax.plot(os.grid, sigma_star,

label='optimal policy', lw=2, alpha=0.6)

ax.plot(os.grid, os.R * sigma_star + 1.01, '-.',

label='next period assets', lw=2, alpha=0.6)

ax.plot(os.grid, os.grid, 'k--',

label='45 degrees', lw=1, alpha=0.6)

ax.legend()

plt.show()

Error at iteration 25 is 0.7349889566684098.

Error at iteration 50 is 0.26488385021986716.

Error at iteration 75 is 0.09546326991181076.

Error at iteration 100 is 0.03440464905678908.

Error at iteration 125 is 0.012399322564725423.

Error at iteration 150 is 0.004468675143598944.

Error at iteration 175 is 0.0016104958504712386.

Error at iteration 200 is 0.0005804174170478404.

Error at iteration 225 is 0.00020918053151319782.

Converged in 244 iterations.

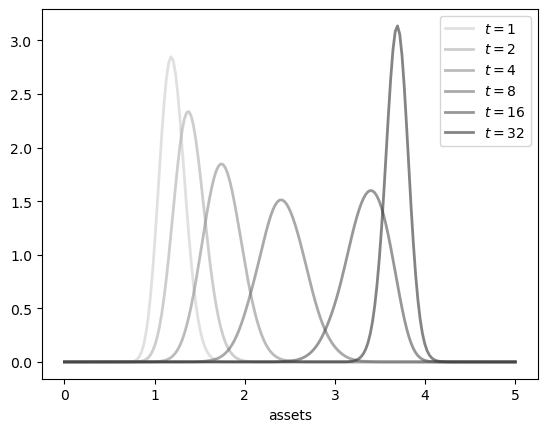

Now we use the look-ahead estimator to compute asset density dynamics under the optimal policy.

# Turn the policy array into a function

sigma = lambda x: interp(os.grid, sigma_star, x)

@vectorize

def phi(z, b):

" Lognormal density for N(0, b^2) "

if z <= 0:

return 0

else:

c1 = k0 / (z * b)

c2 = np.exp(- np.log(z)**2 / (2 * b**2))

return c1 * c2

def p(x, y):

return phi(y - os.R * sigma(x), os.b)

def draws_from_marginal(t_date, init=0, n=10_000):

draws = np.empty(n)

for i in range(n):

a = init

for t in range(t_date):

xi = np.exp(os.b * np.random.randn())

a = os.R * sigma(a) + xi

draws[i] = a

return draws

dates = 1, 2, 4, 8, 16, 32

greys = [str(g) for g in np.linspace(0.2, 0.8, len(dates))]

greys.reverse()

grid = np.linspace(0, 5, 200)

fig, ax = plt.subplots()

for t, g in zip(dates, greys):

a_obs = draws_from_marginal(t)

f = lae_factory(p, a_obs)

ax.plot(grid,

[f(y) for y in grid],

color=g,

lw=2,

alpha=0.6,

label=f'$t={t}$')

ax.set_xlabel('assets')

ax.legend()

plt.show()

Finally we turn to policy function iteration, in order to solve exercise 6.19.

We need to compute the value of any feasible policy \(\sigma\).

To do so we will iterate with the policy value operator \(T_\sigma\).

def T_sigma(v, sigma, os):

"""

Here os is an instance of OptimalSaving and v and sigma

are both arrays defined on the grid.

"""

v_new = np.empty_like(v)

sigma_interp = interp1d(os.grid,

sigma,

fill_value=(sigma[0], sigma[-1]),

bounds_error=False)

for i in range(len(os.grid)):

a = os.grid[i]

v_new[i] = os.state_action_value(sigma_interp(a), a, v)

return v_new

To compute the policy value we iterate until convergence, starting

from some guess of \(v_\sigma\) represented by v_guess.

def compute_policy_value(os,

sigma,

v_guess=None,

tol=1e-3,

max_iter=1000):

if v_guess is None:

v_guess = U(os.grid)

v = v_guess

i = 0

error = tol + 1

while i < max_iter and error > tol:

v_new = T_sigma(v, sigma, os)

error = np.max(np.abs(v - v_new))

i += 1

v = v_new

return v_new

We will use existing code to get a greedy policy from a guess \(v\) of the value function.

def get_greedy(v, os):

sigma, _ = T(v, os)

return sigma

def policy_iteration(os, tol=1e-3, max_iter=1e5, verbose=True):

sigma = np.zeros_like(os.grid) # Initial condition is consume everything

v_guess = U(os.grid) # Starting guess for value function

i = 1

while i < max_iter:

v_sigma = compute_policy_value(os, sigma, v_guess=v_guess)

new_sigma = get_greedy(v_sigma, os)

if np.abs(np.max(new_sigma - sigma)) < tol:

break

else:

sigma = new_sigma

v_guess = v_sigma # Use last computed value to start iteration

i += 1

if i == max_iter:

print("Failed to converge!")

if verbose and i < max_iter:

print(f"\nConverged in {i} iterations.")

return sigma

Running the following code produces essentially the same figure we obtained for the optimal policy when using value function iteration, just as we hoped.

os = OptimalSaving(U, grid_max=4)

sigma_star = policy_iteration(os)

fig, ax = plt.subplots()

ax.plot(os.grid, sigma_star,

label='optimal policy', lw=2, alpha=0.6)

ax.plot(os.grid, os.R * sigma_star + 1.01, '-.',

label='next period assets', lw=2, alpha=0.6)

ax.plot(os.grid, os.grid, 'k--',

label='45 degrees', lw=1, alpha=0.6)

ax.legend()

plt.show()

Converged in 7 iterations.

Stochastic Speculative Price#

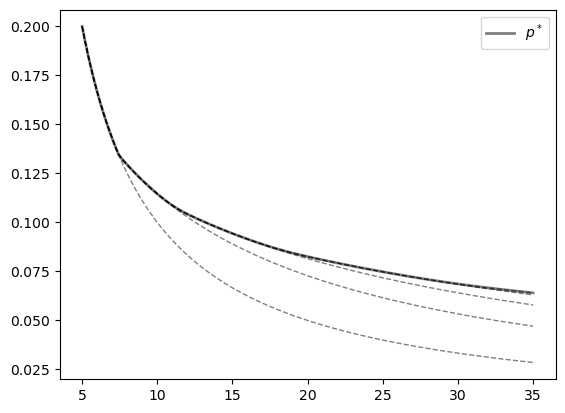

Finally, to conclude code for this chapter, we turn to the commodity pricing model.

The next code block computes figure 6.16 and hence solves exercise 6.26.

alpha, a, c = 0.8, 5.0, 2.0

beta_a, beta_b = 5, 5

mc_draw_size = 250

gridsize = 150

grid_max = 35

grid = np.linspace(a, grid_max, gridsize)

beta_dist = beta(5, 5)

W = a + beta_dist.rvs(mc_draw_size) * c # Shock observations

D = P = lambda x: 1.0 / x

tol = 1e-4

def fix_point(h, lower, upper):

"Computes the fixed point of h on [upper, lower]."

return brentq(lambda x: x - h(x), lower, upper)

def T(p_array):

new_p = np.empty_like(p_array)

# Interpolate to obtain p as a function.

p = interp1d(grid,

p_array,

fill_value=(p_array[0], p_array[-1]),

bounds_error=False)

for i, x in enumerate(grid):

y = alpha * np.mean(p(W))

if y <= P(x):

new_p[i] = P(x)

continue

h = lambda r: alpha * np.mean(p(alpha*(x - D(r)) + W))

new_p[i] = fix_point(h, P(x), y)

return new_p

fig, ax = plt.subplots()

price = P(grid)

error = tol + 1

while error > tol:

ax.plot(grid, price, 'k--', alpha=0.5, lw=1)

new_price = T(price)

error = max(np.abs(new_price - price))

price = new_price

ax.plot(grid, price, 'k-', alpha=0.5, lw=2, label=r'$p^*$')

ax.legend()

plt.show()

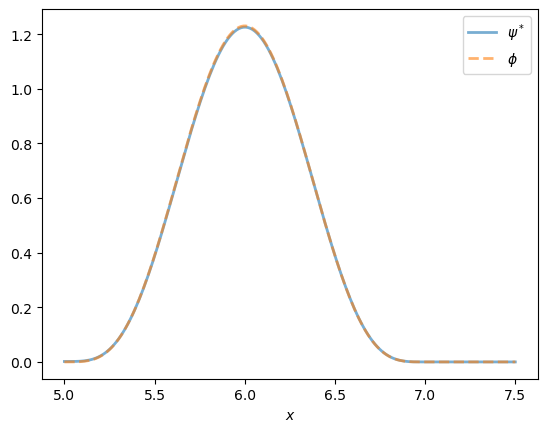

Our final task for this chapter is to solve exercise 6.28, which involves computing the stationary density of the associated state process for quantities.

To do so we use the look ahead estimator.

# Turn the price array into a price function

p_star = lambda x: interp(grid, price, x)

def carry_over(x):

return alpha * (x - D(p_star(x)))

def phi(z):

"Shock distribution computed by change of variables."

return beta_dist.pdf((z - a)/c) / c

def p(x, y):

return phi(y - carry_over(x))

def generate_cp_ts(init=0, n=1000):

X = np.empty(n)

X[0] = init

for t in range(n-1):

W = a + c * beta_dist.rvs()

X[t+1] = carry_over(X[t]) + W

return X

fig, ax = plt.subplots()

plot_grid = np.linspace(a, a * 1.5, 200)

x_ts = generate_cp_ts()

f = lae_factory(p, x_ts)

ax.plot(plot_grid,

[f(y) for y in plot_grid],

lw=2,

alpha=0.6,

label=r'$\psi^*$')

ax.plot(plot_grid,

phi(plot_grid),

'--',

lw=2,

alpha=0.6,

label=r'$\phi$')

ax.set_xlabel('$x$')

ax.legend()

plt.show()

As claimed in the statement of the exercise, the two distributions line up exactly.

Hence, for these particular parameters, speculation has no impact on long run average outcomes.

If we change parameters to make storage more attractive, then we will see differences between the distributions.