Chapter 4 Code#

Let’s start with some imports.

import numpy as np

import matplotlib.pyplot as plt

from numba import jit

from quantecon import MarkovChain

Introduction to Dynamics#

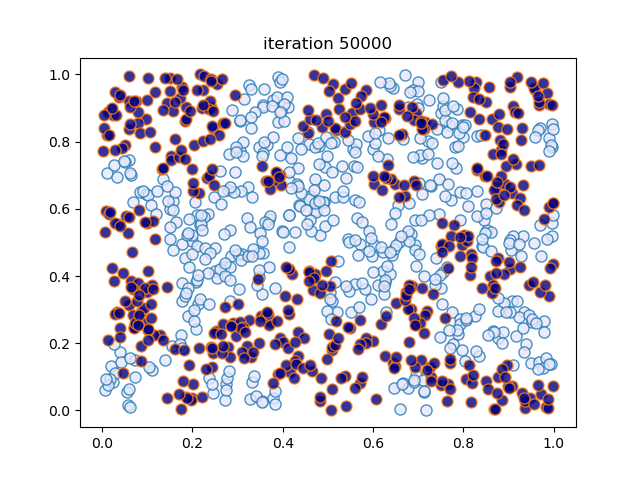

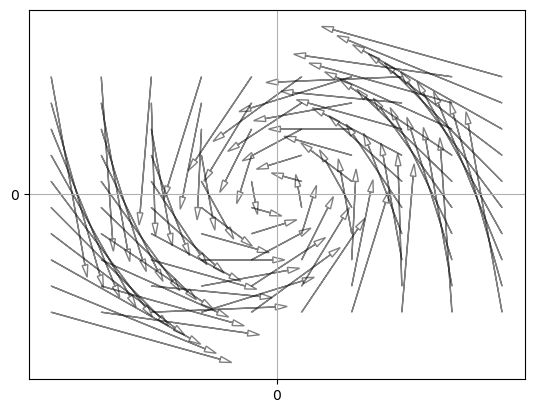

Here’s the code that generated figure 4.1.

def draw_arrow(x, y, xp, yp, ax):

"""

Draw an arrow from (x, y) to (xp, yp).

"""

v1, v2 = xp - x, yp - y

eps = 1.0

nrm = np.sqrt(v1**2 + v2**2)

scale = 1.0

ax.arrow(x, y, scale * v1, scale * v2,

antialiased=True,

alpha=0.5,

head_length=0.025*(xmax - xmin),

head_width=0.012*(xmax - xmin),

fill=False)

xmin, xmax = -10.0, 10.0

ymin, ymax = -5.0, 5.0

A1 = np.asarray([[0.55, -0.6],

[0.5, 0.4]])

def f(x, y):

return A1 @ (x, y)

xgrid = np.linspace(xmin * 0.95, xmax * 0.95, 10)

ygrid = np.linspace(ymin * 0.95, ymax * 0.95, 10)

fig, ax = plt.subplots()

#ax.set_xlim(xmin, xmax)

#ax.set_ylim(ymin, ymax)

ax.set_xticks((0,))

ax.set_yticks((0,))

ax.grid()

for x in xgrid:

for y in ygrid:

xp, yp = f(x, y)

draw_arrow(x, y, xp, yp, ax)

#plt.savefig("sdsdiagram.pdf") # Uncomment to save figure

plt.show()

And here’s the code that generated figure 4.2.

def draw_trajectory(x, y, ax, n=10):

"""

Draw the trajectory of length n starting from (x, y).

"""

for i in range(n):

x_new, y_new = f(x, y)

draw_arrow(x, y, x_new, y_new, ax)

x, y = x_new, y_new

xgrid = np.linspace(xmin * 0.95, xmax * 0.95, 3)

ygrid = np.linspace(ymin * 0.95, ymax * 0.95, 3)

fig, ax = plt.subplots()

#ax.set_xlim(xmin, xmax)

#ax.set_ylim(ymin, ymax)

ax.set_xticks((0,))

ax.set_yticks((0,))

ax.grid()

for x in xgrid:

for y in ygrid:

draw_trajectory(x, y, ax)

#plt.savefig("sdsstable.pdf") # Uncomment to save figure

plt.show()

Chaotic Dynamics#

Just for fun, here’s a little class that allows us to simulate trajectories from a specified dynamical system:

class DS:

def __init__(self, h=None, x=None):

"""Parameters: h is a function and x is an

element of S representing the current state."""

self.h, self.x = h, x

def update(self):

"Update the state of the system by applying h."

self.x = self.h(self.x)

def trajectory(self, n):

"""Generate a trajectory of length n, starting

at the current state."""

traj = []

for i in range(n):

traj.append(self.x)

self.update()

return traj

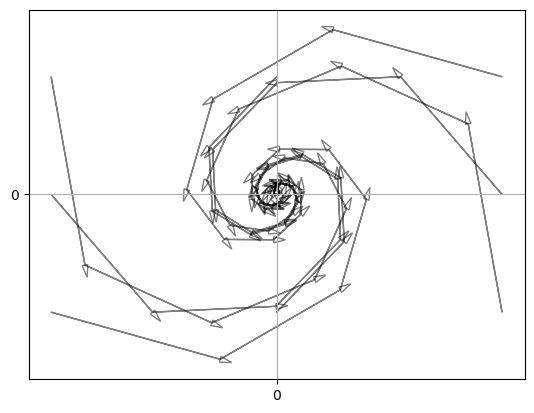

As in the textbook, let’s plot a trajectory starting from 0.11.

q = DS(h=lambda x: 4 * x * (1 - x), x=0.11)

t = q.trajectory(200)

fig, ax = plt.subplots()

ax.plot(t)

plt.show()

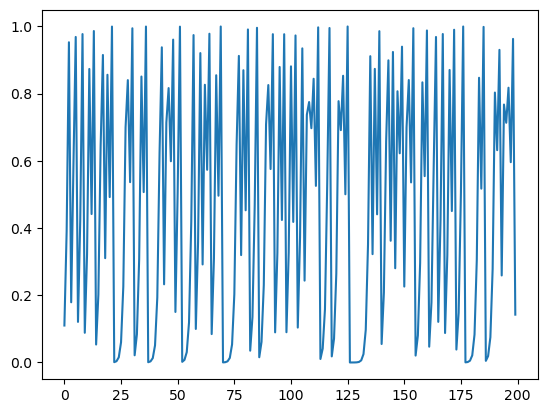

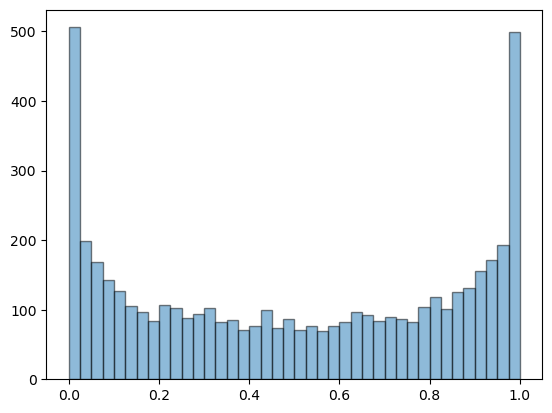

Now let’s generate a histograms from a long trajectory, to address exercise 4.16.

q.x = 0.11

t = q.trajectory(5000)

fig, ax = plt.subplots()

ax.hist(t, bins=40, alpha=0.5, edgecolor='k')

plt.show()

If you experiment with different initial conditions you will find that, for all most all choices, the histogram looks the same.

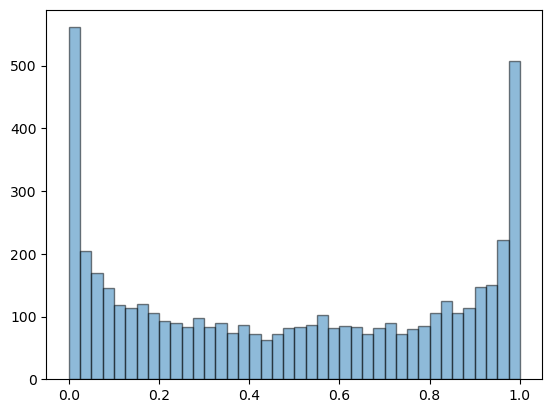

q.x = 0.65

t = q.trajectory(5000)

fig, ax = plt.subplots()

ax.hist(t, bins=40, alpha=0.5, edgecolor='k')

plt.show()

What we have learned is that, although the trajectories seem very random, when we take a statistical perspective we can make predictions.

In particular, we can say what will happen “one average, in the long run.”

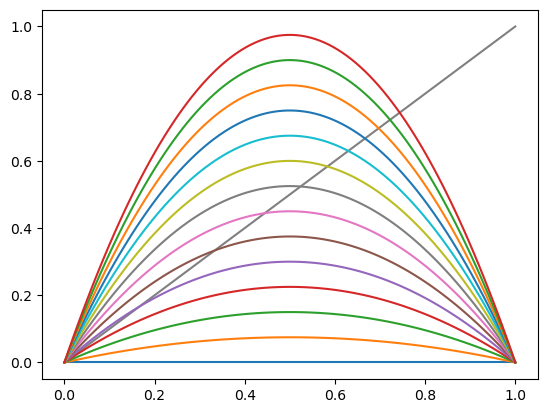

Here’s the set of maps.

xgrid = np.linspace(0, 1, 100)

h = lambda x, r: r * x * (1 - x)

fig, ax = plt.subplots()

ax.plot(xgrid, xgrid, '-', color='grey')

r = 0

step = 0.3

while r <= 4:

y = [h(x, r) for x in xgrid]

ax.plot(xgrid, y)

r = r + step

plt.show()

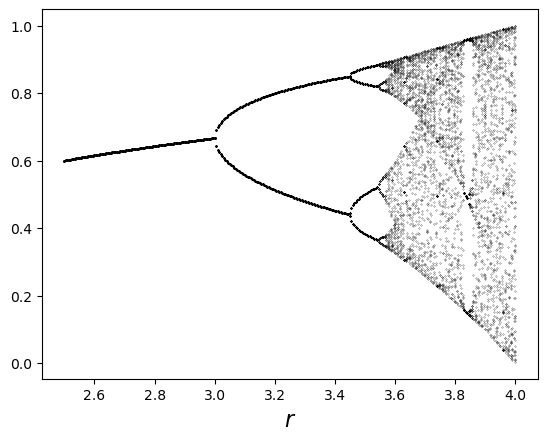

Here’s the bifurcation diagram.

q = DS(h=None, x=0.1)

fig, ax = plt.subplots()

r = 2.5

while r < 4:

q.h = lambda x: r * x * (1 - x)

t = q.trajectory(1000)[950:]

ax.plot([r] * len(t), t, 'k.', ms=0.4)

r = r + 0.005

ax.set_xlabel('$r$', fontsize=16)

plt.show()

Markov Chains#

Our first task is to simulate time series from Hamilton’s Markov chain

p_H = ((0.971, 0.029, 0.000), # Hamilton's kernel

(0.145, 0.778, 0.077),

(0.000, 0.508, 0.492))

p_H = np.array(p_H) # Convert to numpy array

S = np.array((0, 1, 2))

We’ll borrow this code from Chapter 2.

@jit

def tau(z, S, phi):

i = np.searchsorted(np.cumsum(phi), z)

return S[i]

(We have targeted the function for JIT compilation via @jit because we need

fast execution below.)

As discussed in that chapter, if we create a function tau using this code and feed it uniform draws on \((0,1]\), we get draws from S distributed according to phi.

Here’s some code to generate a trajectory starting at \(x \in S\), using stochastic kernel \(p\).

def trajectory(x, p, S, n=100):

X = np.empty(n, dtype=int)

X[0] = x

for t in range(n-1):

W = np.random.rand()

X[t+1] = tau(W, S, p[X[t], :])

return X

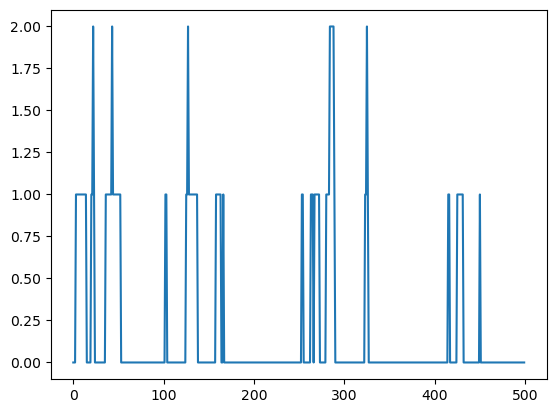

Let’s plot a trajectory.

fig, ax = plt.subplots()

X = trajectory(0, p_H, S, n=500)

ax.plot(X)

plt.show()

Another option is to use existing code from QuantEcon. This code is JIT-compiled and very fast.

mc = MarkovChain(p_H, state_values=S)

X = mc.simulate(init=0, ts_length=500)

fig, ax = plt.subplots()

ax.plot(X)

plt.show()

Here’s a solution to exercise 4.23.

@jit

def compute_marginal(n=100_000, T=10):

X_vals = np.empty(n)

for i in range(n):

X = 2 # start in state SR

for t in range(T):

W = np.random.rand()

X = tau(W, S, p_H[X, :])

X_vals[i] = X

return np.mean(X_vals == 0)

compute_marginal()

0.59799

The answer is close to 0.6, as expected.

Here’s a solution to exercise 4.24.

@jit

def compute_marginal_2(n=100_000, T=10):

counter = 0

for i in range(n):

X = 2 # start in state SR

for t in range(T):

W = np.random.rand()

X = tau(W, S, p_H[X, :])

if X == 0:

counter += 1

return counter / n

compute_marginal_2()

0.59549

Here’s a solution to exercise 4.29.

T = 5

psi = (1, 0, 0) # start in NG

h = (1000, 0, -1000) # profits

for t in range(T):

psi = psi @ p_H

print(psi @ h)

885.347632676323

Now let’s see what happens when we start in severe recession.

psi = (0, 0, 1)

for t in range(T):

psi = psi @ p_H

print(psi @ h)

217.74304876607997

Profits are much lower because the Markov chain is relatively persistent, implying that starting in recession increases the probability of recession at date \(t=5\).

Here’s a solution to exercise 4.30.

T = 1000

for i in (0, 1, 2):

psi = np.zeros(3)

psi[i] = 1

for t in range(T):

psi = psi @ p_H

print(f"Profits in state {i} at date {T} equals {psi @ h}")

Profits in state 0 at date 1000 equals 788.1599999999967

Profits in state 1 at date 1000 equals 788.1599999999974

Profits in state 2 at date 1000 equals 788.1599999999972

Notice that profits are almost invariant with respect to the initial condition.

This is due to inherent stability of the kernel, which implies that initial conditions become irrelevant after sufficient time has elapsed.

Here’s a solution to exercise 4.31.

T = 5

psi = (0.2, 0.2, 0.6)

for t in range(T):

psi = psi @ p_H

print(psi @ h)

385.45189053788556

Here’s a solution to exercise 4.32.

def path_prob(p, psi, X): # X gives a time path

prob = psi[X[0]]

for t in range(len(X)-1):

prob = prob * p[X[t], X[t+1]]

return prob

psi = np.array((0.2, 0.2, 0.6))

prob = path_prob(p_H, psi, (0, 1, 0))

print(prob)

0.0008410000000000001

Here’s a solution to exercise 4.33.

counter = 0

recession_states = 1, 2

for x0 in recession_states:

for x1 in recession_states:

for x2 in recession_states:

path = x0, x1, x2

counter += path_prob(p_H, psi, path)

print(counter)

0.704242

Here’s a solution to exercise 4.34.

counter = 0

m = 10_000

mc = MarkovChain(p_H)

for i in range(m):

x0 = tau(np.random.rand(), S, psi)

X = mc.simulate(init=x0, ts_length=3)

if 0 not in X:

counter += 1

print(counter / m)

0.7021

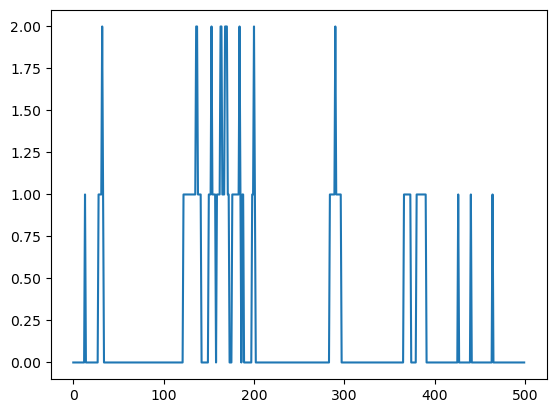

Next we turn to exercise 4.36.

max_T = 12

T_vals = range(max_T)

profits = []

r = 0.05

rho = 1 / (1+r)

psi = (0.2, 0.2, 0.6)

h = (1000, 0, -1000)

current_profits = np.inner(psi, h)

discount = rho

Q = np.identity(3)

for t in T_vals:

Q = Q @ p_H

current_profits += discount * np.inner(psi, Q @ h)

profits.append(current_profits)

discount = discount * rho

fig, ax = plt.subplots()

ax.plot(profits, label='profits')

ax.plot(np.zeros(max_T), '--', label='break even')

ax.set_xlabel('time')

ax.legend()

plt.show()

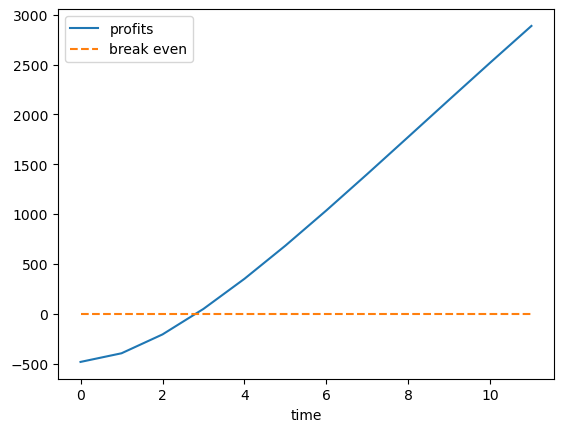

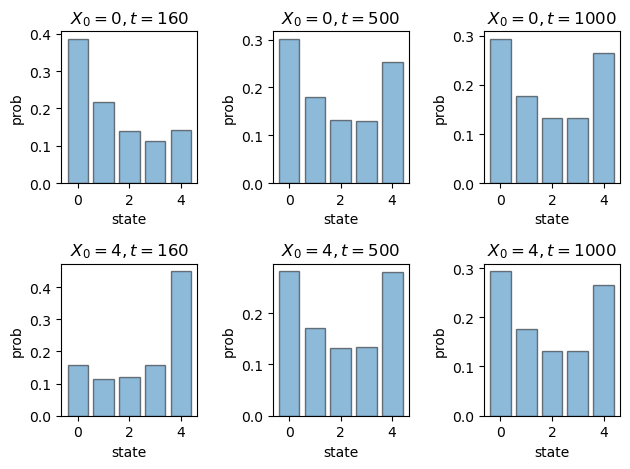

Here’s figure 4.11.

p_Q = ((0.97 , 0.03 , 0.00 , 0.00 , 0.00),

(0.05 , 0.92 , 0.03 , 0.00 , 0.00),

(0.00 , 0.04 , 0.92 , 0.04 , 0.00),

(0.00 , 0.00 , 0.04 , 0.94 , 0.02),

(0.00 , 0.00 , 0.00 , 0.01 , 0.99))

p_Q = np.array(p_Q)

states = 0, 1, 2, 3, 4

dates = 10, 60, 160

initial_states = 0, 4

rows, cols = 2, 3

fig, axes = plt.subplots(rows, cols)

for row, init in enumerate(initial_states):

psi = np.zeros(5)

psi[init] = 1

for col, d in enumerate(dates):

ax = axes[row, col]

ax.bar(states,

psi @ np.linalg.matrix_power(p_Q, d),

alpha=0.5,

edgecolor='k')

ax.set_title(f"$X_0 = {init}, t = {d}$")

ax.set_ylabel("prob")

ax.set_xlabel("state")

plt.tight_layout()

#plt.savefig("dds2.pdf")

plt.show()

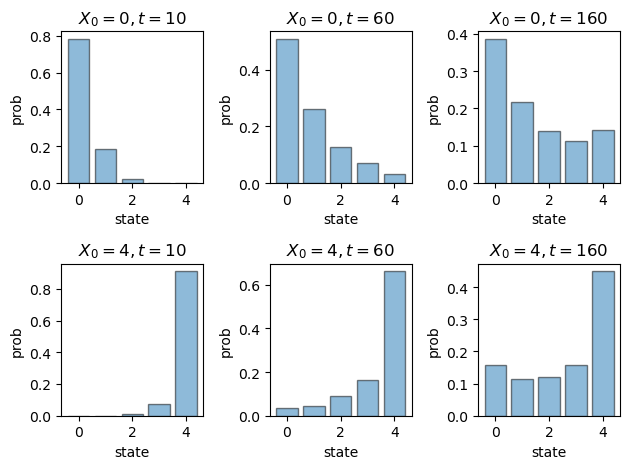

And here’s figure 4.12.

dates = 160, 500, 1000

fig, axes = plt.subplots(rows, cols)

for row, init in enumerate(initial_states):

psi = np.zeros(5)

psi[init] = 1

for col, d in enumerate(dates):

ax = axes[row, col]

ax.bar(states,

psi @ np.linalg.matrix_power(p_Q, d),

alpha=0.5,

edgecolor='k')

ax.set_title(f"$X_0 = {init}, t = {d}$")

ax.set_ylabel("prob")

ax.set_xlabel("state")

plt.tight_layout()

#plt.savefig("dds3.pdf")

plt.show()

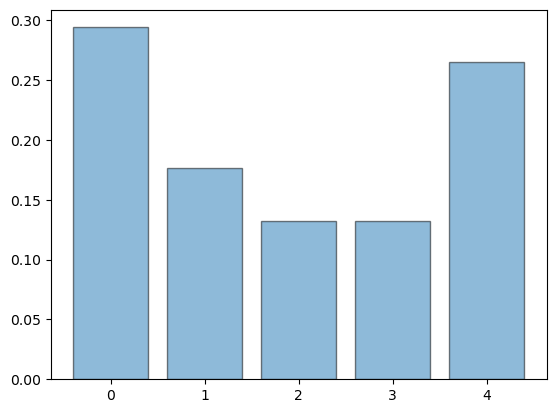

Next we turn to exercise 4.42.

First here’s a function to compute the stationary distribution, assuming it is unique.

from numpy.linalg import solve

def compute_stationary(p):

N = p.shape[0]

I = np.identity(N)

O = np.ones((N, N))

A = I - p + O

return solve(A.T, np.ones((N, 1))).flatten()

Now let’s apply it to p_Q.

psi_star = compute_stationary(p_Q)

fig, ax = plt.subplots()

ax.bar(states, psi_star, alpha=0.5, edgecolor='k')

plt.show()

As expected, the distribution is very similar to the time 1,000 distribution we obtained above by shifting forward in time.

Now let’s look at exercise 4.43.

psi_star = compute_stationary(p_H)

print(np.inner(psi_star, h))

788.1600000000004

If we compute profits at \(t=1000\), starting from a range of initial conditions, we get very similar results.

pT = np.linalg.matrix_power(p_H, 1000)

psi_vecs = (1, 0, 0), (0, 1, 0), (0, 0, 1)

for psi in psi_vecs:

print(np.inner(psi, pT @ h))

788.159999999977

788.1599999999776

788.1599999999777

This is not surprising, since p_H is globally stable.

Here’s the solution to exercise 4.57, which computes mean return time.

I’ll use JIT compilation to make the code fast.

@jit

def compute_return_time(x, p, max_iter=100_000):

X = x

t = 0

while t < max_iter:

W = np.random.rand()

X = tau(W, S, p_H[X, :])

t += 1

if X == x:

return t

@jit

def compute_mean_return_time(x, p, n=100_000):

counter = 0

for i in range(n):

counter += compute_return_time(x, p)

return counter / n

[compute_mean_return_time(i, p_H) for i in range(3)]

[1.23226, 6.17647, 40.34466]

For comparison:

psi_star = compute_stationary(p_H)

1/ psi_star

array([ 1.23031496, 6.1515748 , 40.58441558])

As predicted by the theory, the values are approximately equal.

Now let’s turn to the inventory model.

def b(d):

" Returns probability that demand = d."

return (d >= 0) * (1/2)**(d + 1)

def h(x, q, Q):

return x + (Q - x) * (x <= q)

def build_p(q=2, Q=5):

p = np.empty((Q+1, Q+1))

for x in range(Q+1):

for y in range(Q+1):

if y == 0:

p[x,y] = (1/2)**h(x, q, Q) # prob D >= h(x, q)

else:

p[x,y] = b(h(x, q, Q) - y) # prob h(x, q) - D = y

return p

Let’s verify that the stationary distribution at \(q=2\) and \(Q=5\) matches the one shown in the text.

p = build_p()

compute_stationary(p)

array([0.0625, 0.0625, 0.125 , 0.25 , 0.25 , 0.25 ])

Yep, looks good.

Now let’s check that the optimal policy agrees with \(q=7\), as claimed in the text.

Q = 20 # inventory upper bound

C = 0.1 # cost of restocking

# profit given state x, demand d, policy q

def profit(x, d, q):

stock = h(x, q, Q)

revenue = stock if stock < d else d

cost = C * (x <= q)

return revenue - cost

# expected profit given x and policy q

def g(x, q):

counter = 0

for d in range(1000):

counter += profit(x, d, q) * b(d)

return counter

def profit_at_stationary(q):

p = build_p(q=q, Q=Q)

stationary = compute_stationary(p)

counter = 0

for x in range(Q+1):

counter += g(x, q) * stationary[x]

return counter

def compute_optimal_policy():

running_max = -np.inf

for q in range(Q+1):

counter = profit_at_stationary(q)

if counter > running_max:

running_max = counter

argmax = q

return(argmax)

compute_optimal_policy()

7

Here’s a solution for exercise 4.61. From preceding calculations we have the stationary probability assigned to normal growth:

psi_star = compute_stationary(p_H)

psi_star[0]

0.8128000000000003

The fraction of the time a long path spends in this state can be calculated as follows.

T = 1_000_000

mc = MarkovChain(p_H)

X = mc.simulate(init=0, ts_length=T)

np.mean(X == 0)

0.811182

As expected given the LLN results for stable Markov chains, the two numbers are approximately equal.

Finally, let’s look at the expected profits question in exercise 4.63.

Previously we calculated steady state profits via

h = (1000, 0, -1000)

psi_star = compute_stationary(p_H)

print(np.inner(psi_star, h))

788.1600000000004

To check that we get approximately the same results when simulating a long time series, we can calculate as follows.

y = [h[x] for x in X]

np.mean(y)

786.056